In the article Scalability of Cryptocurrencies and Blockchain, we delve deeply into promising blockchain developments that may enable near-instantaneous transaction speeds in cryptocurrencies.

Key points:

- Blockchain scalability refers to the ability of a blockchain network to handle increasing volumes of transactions and data without compromising performance, security, or decentralization.

- Throughput, transaction finalization, and confirmation time are the three main bottlenecks for blockchain scalability. The proposed solutions all aim to address these issues.

- The blockchain scalability triad (scalability, decentralization, security) may be a difficult problem to solve, but it is not something that is completely unachievable.

- Three directions that blockchains are moving in to increase scalability include new consensus mechanisms and on-chain and off-chain solutions.

Introduction to Cryptocurrency Scalability

Blockchain scalability is arguably the holy grail and bottleneck of the cryptocurrency world.

This mainly refers to transaction speed, as the current transaction times of many cryptocurrencies are not comparable to other payment methods.

However, crypto communities are working with various theories on how best to overcome this obstacle.

In this section, we take a deep dive into promising developments that may eventually bring instant transaction speeds to cryptocurrencies.

Why Scalability Matters: Cryptocurrency Transaction Speed

While Visa's payment method can process up to 24,000 transactions per second (TPS), Bitcoin can process only seven TPS.

Ethereum, Bitcoin’s closest competitor, can handle 20-30 TPS. It’s clear that cryptocurrencies need to at least approach the capabilities of traditional financial transactions to achieve mass adoption.

But why is scaling in cryptocurrencies so difficult? What guidelines do those in the industry have? This article answers these questions and more.

Bottlenecks: throughput, finality, and approval time

What does TPS have to do with processing speed? When you are asked whether a cryptocurrency is scalable, what exactly does it mean? To answer these questions, we first need to understand the concepts of throughput, finality, and confirmation time.

Consider this story:

A person waits for a bus that comes every 10 minutes. Then it takes 60 minutes for the bus to take them to their destination. However, this particular route is popular and there are always many people trying to get on the bus.

Two minutes passed and the bus arrived. Unfortunately, there were many people in line ahead of this person and the bus was full. They now had to wait another 10 minutes before they could begin their journey.

In the story above, the bus capacity is 7 people per minute, which is the operating capacity.

The arrival time at the destination, which is 60 minutes, is the final time, and the travel time, including the 10-minute wait, is 70 minutes, which is the confirmation time.

It should be noted that:

- Measuring throughput (TPS) is not enough – confirmation time must also be considered. Simply put, a protocol that can process up to 100,000 TPS is great. However, if it has a confirmation time of two days, it will not be sufficient for daily use.

- When there is network congestion, throughput does not decrease (because the bus can still carry seven passengers per minute), but confirmation time increases because the average first block waiting time is longer.

- Finality is fixed: Wait for a “six-block confirmation” to ensure block irreversibility. The average wait time for the first block varies depending on the situation.

Three ways to scale blockchain

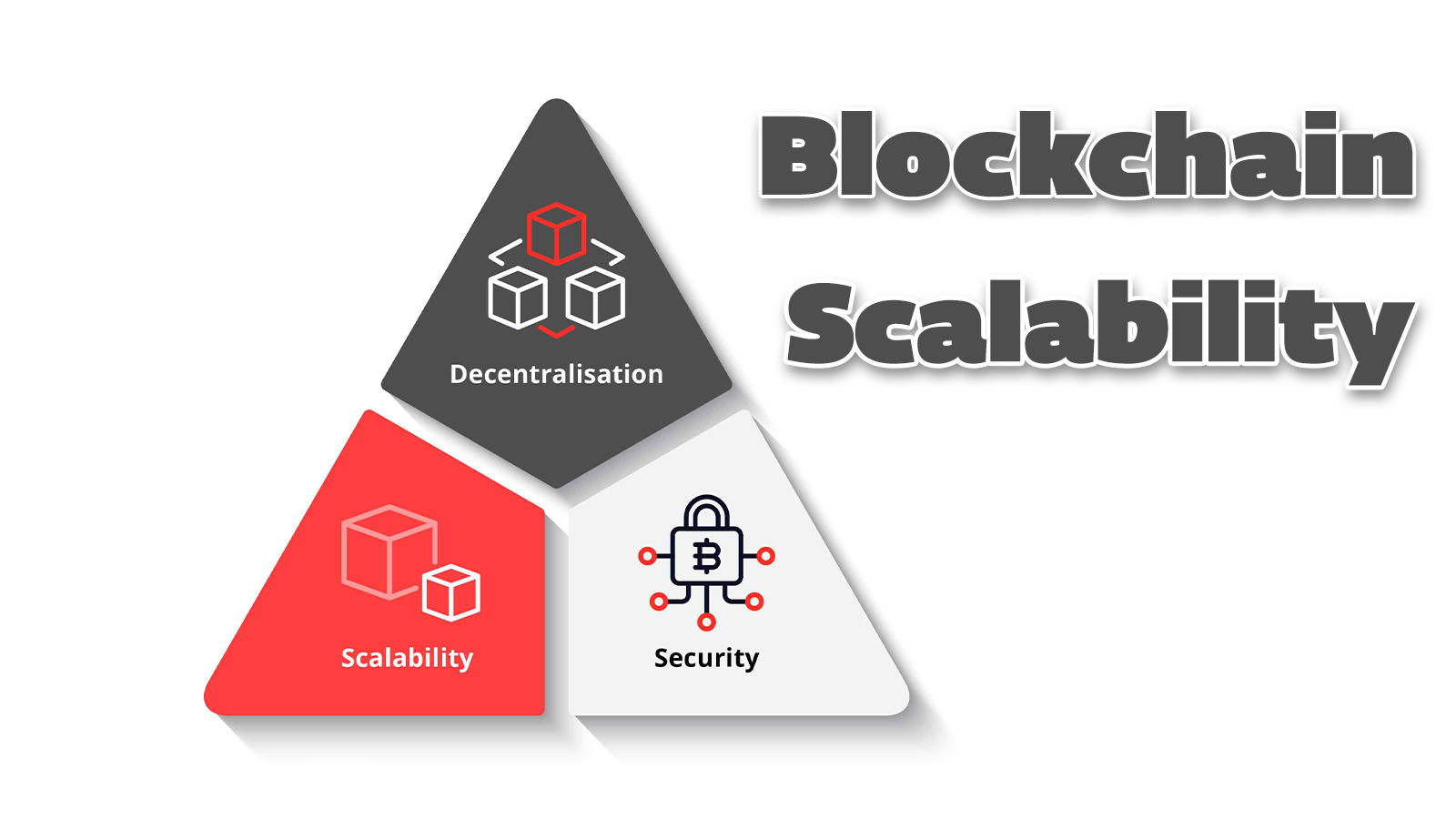

The three-way scalability of cryptocurrencies is one of the biggest obstacles to cryptocurrencies. It states that blockchains can only achieve two of decentralization, scalability, or security at the same time, but never all three!

The concept of trilemma was originally coined by Vitalik Buterin, the founder of Ethereum.

A. Decentralization

Decentralization refers to the degree of diversity in ownership, influence, and value on a blockchain. Cryptocurrencies are generally decentralized because no single party can control the entire network.

However, decentralization is a spectrum rather than a binary “yes or no,” as there are varying levels of decentralization in different blockchain projects, including Bitcoin and Ethereum.

B. Security

Security is the level of defense and tamper resistance of a blockchain against attacks from external sources. There are many attack vectors on a blockchain system, including double-spending, distributed denial of service (DDoS), and 51% attacks.

In general, more freedom (i.e. free entry/exit of the network) leads to more decentralization but less security.

This is because it is difficult to verify the identity of new participants, as they could potentially belong to a single malicious entity or collude together to harm a network.

C. Scalability

Scalability determines the capacity of the network, including the number of nodes it has, the number of transactions it can process and the speed at which they are processed, and other factors.

The term scalability is sometimes confusing because the Bitcoin blockchain scales as new participants join the network.

The Proof-of-Work (PoW) system automatically adjusts the mining difficulty and the network can support any number of nodes it has.

The common adage that “Bitcoin is not scalable” focuses on its throughput. Remember, its TPS is only seven, which is not high enough for practical use.

Bitcoin's ultimate speed is another matter. Waiting 60 minutes for a purchase to be confirmed valid is certainly far from ideal.

Increasing the scalability of cryptocurrencies

Scaling a blockchain is complex, and there are many efforts by researchers and businesses to solve this trifecta. In general, we believe there are three paths to blockchain scalability:

- Layer 1 (on-chain)

- Layer 2 (off-chain)

- Other consensus mechanisms

Layer 1 (on-chain) solutions

Layer 1 solutions require changes to the Bitcoin code. An on-chain scalability solution represents a structural or fundamental change to a blockchain. Here, we discuss two on-chain scaling solutions: SegWit and Sharding.

SegWit:

SegWit is a protocol upgrade for Bitcoin that changes the method and structure of how data is stored.

SegWit's initial goal was to solve the problem of transaction malleability, as the digital signature that verifies the ownership and availability of the sender's funds takes up a lot of space in a transaction.

With SegWit, removing signature data for each transaction frees up more space and capacity for transactions in Bitcoin's 1MB storage blocks, allowing for more transactions to be included in a single block.

SegWit has already been implemented in Litecoin.

Although SegWit increases throughput and helps Bitcoin process more transactions, it is not a sustainable scalability solution.

This is not a general scaling solution and can only be applied to an existing Bitcoin-based blockchain.

Although SegWit enables Bitcoin to process more transactions, it does not reduce the time it takes to confirm each transaction.

Further reading: Types of Bitcoin wallet addresses

Sharding:

Sharding is a type of database partitioning, also known as horizontal partitioning.

This is the process of breaking down a large database into smaller, more manageable parts, with the idea of improving performance and reducing query response time.

A blockchain is a distributed database, and if we apply sharding to a blockchain, the network is divided into different parts.

Each sector is managed by specific nodes assigned to them.

Because of this, the system throughput is greatly improved because, optionally, many node clusters are running in parallel to process transactions.

Layer 2 Crypto Scalability Solutions (Off-Chain)

Layer 2 scalability solutions, or off-chain (off the main chain) solutions, add a second layer to the main blockchain network (also known as the mainnet) to facilitate faster transactions.

Secondary protocols are built on top of the main chain, where transactions are “offloaded” to save space and reduce network congestion.

Side chains:

A sidechain is a separate blockchain connected to the main chain, where assets are traded between the main chain and the sidechain at predetermined rates using a two-way peg.

Sidechains are used to offload from the main chain by moving specific applications to them. They are one of the most promising solutions to the scalability problem if communication between blockchains becomes more efficient.

Multiple sidechains can be connected to the main chain, and each sidechain can have its own architecture.

A network of sidechains can be created with a main chain, where the main chain acts as a relay network and the sidechains represent a blockchain network.

Plasma (Ethereum) and Parachain (Polkadot) are popular scaling solutions using sidechains and relays.

Payment channels:

A payment channel is an off-chain network that runs parallel to the main chain. The idea is to create a channel between two parties who want to transact.

All transactions that take place on the channel are off-chain and do not require global consensus. As a result, these transactions are executed quickly through a smart contract, generally with lower fees.

A typical payment channel consists of three steps:

Phase 1: Creating a channel with signatures and funding it.

Phase 2: Peer-to-peer (P2P) transactions that occur on the channel.

Phase 3: The channel is closed and the final state of the main chain is broadcast.

There are several different designs for payment channels. The Lightning Network (Bitcoin) and the Raiden Network (Ethereum) are popular payment channel implementations.

Consensus mechanisms and why they are important for transaction speed and scalability of cryptocurrencies

The difficulty of scaling a blockchain is mainly due to its consensus mechanism as it requires all participants in the network to agree on which transactions are valid.

While Bitcoin can scale to a large number of participants (nodes), it cannot scale to a large number of transactions.

Therefore, some alternative consensus mechanisms have emerged as attempts to solve the problem. Below we introduce three: Nakamoto, classical, and leaderless.

Nakamoto consensus mechanisms

Satoshi Nakamoto's PoW consensus mechanism opened a new path to solving the Byzantine generals problem in a permissionless setup.

Following the development of the PoW consensus mechanism, many new consensus algorithms emerged.

These include: Proof of Stake (PoS), Proof of Authority (PoA), Proof of Reputation (PoR), and Proof of Importance (PoI).

Generally, these are classified as Nakamoto consensus mechanisms.

Classical consensus mechanisms

Classical consensus mechanisms are traditional algorithms that were researched before the invention of Bitcoin.

They focus on fixed peer sets with multiple rounds of voting to reach a consensus across the entire network.

Examples of networks that use classical consensus mechanisms include Paxos, Raft, and pBFT.

After the invention of Bitcoin, classic consensus mechanisms also evolved with new variations such as delegated BFT (dBFT), federated BFT (fBFT), Tendermint, and more.

These mechanisms are more compatible with a permissionless environment.

Leaderless consensus mechanisms

Traditional (like BFT) and Nakamoto (like PoW) consensus mechanisms are leader-based and require the entire network to elect a leader for block proposals, transactions,

Select ledger states and more so that the rest of the network can vote on whether to approve or disapprove of the proposal.

However, there is an emerging direction using leaderless consensus mechanisms, where all participants in the network are allowed to propose recent transactions,

Which then spread like rumors throughout the network. Eventually, the blockchain agrees on which transactions to include.

Examples of projects that use a leaderless consensus mechanism include Avalanche, IOTA, and NKN.

While leaderless consensus mechanisms appear to provide a way to solve the scalability triad, most of them are currently experimental.

Final words on cryptocurrency scalability solutions

Despite the major hurdles that blockchain still faces, namely the scalability triad, there are several potential solutions to increase transaction times, including sharding and the Lightning Network, in addition to solutions proposed by the community.